Dollar Weakens Mildly after ADP Miss, Yen Selloff Continues

Dollar weakens mildly in early US session after big ADP job data miss. But Swiss Franc and Yen remain the weaker ones. Euro and Sterling firm up mildly. But they are outshone by Aussie and Loonie for the moment. Overall...

EUR/USD Elliott Wave Analysis: Be Aware Of More Weakness

The USD is coming up vs EUR despite hawkish ECB and dovish FED on Friday, so this can be a temporary contra-trend reaction. Looking at DXY, we are observing two wave counts where both suggests more weakness but after higher...

US Dollar Has Reason To Rise

Stock markets paused growth yesterday, with the dollar gaining support on the downturn and US indices correcting by around 0.1% from their peaks. Declines in Europe ranged from 0.1% in the CAC 40 to 0.3% in the DAX and 0.4%...

Dollar Losing Downside Momentum, Sellers Turn to Yen and Franc

Dollar recovers broadly today, as the near term decline lost momentum. Selling focus is turned to Yen and Swiss Franc instead. Traders are now awaiting key economic indicators from the US, while would start with ADP employment and ISM manufacturing...

Elliott Wave View: Further Upside In Silver In Near Term

Short-term Elliott wave view in Silver (XAGUSD) suggests the rally from August 9, 2021 low is unfolding as a double three Elliott Wave structure. Up from August 9 low, wave W ended at 24.04 and dips in wave X ended...

Stock futures open slightly higher following another record-setting month for the S&P 500

Traders work on the floor of the New York Stock Exchange (NYSE), Aug. 3, 2021. Michael Nagle | Bloomberg | Getty Images U.S. stock futures opened slightly higher Tuesday night after the S&P 500 notched a seven-month win streak in...

Two more factors have popped up that add to the Fed’s inflation worries

A home, available for sale, is shown on August 12, 2021 in Houston, Texas. Brandon Bell | Getty Images Trends in home prices and consumer expectations that were part of data releases Tuesday pointed to more inflationary issues on the...

EU CPI Surprises. Hawks Come Out!

Earlier today, the EU released its Flash CPI data for August. The YoY print was 3% vs 2.7% expected and 2.2% in July. This is the highest reading in nearly 10 years! Just as with much of the rest of...

Gold – Can the Rally Continue?

Facing resistance around $1,833 Gold was given a helping hand by Jerome Powell and the Fed on Friday when they signalled that they can be patient on tapering and that it is not linked to interest rates. The comments brought...

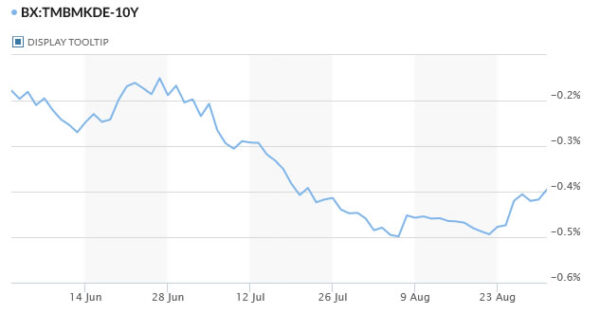

Euro Rises on Inflation, ECB Talks, and German Yield

Euro jumps notably today, as supported by highest inflation reading in a decade, and hawkish comments from an ECB official, as well as rise in German yields. Though, it’s slightly outshone by Kiwi, Aussie and Swiss Franc for now. On...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals