The Fed is likely to signal a March interest rate hike and that further policy tightening is coming

U.S. Federal Reserve Board Chairman Jerome Powell speaks during his re-nominations hearing of the Senate Banking, Housing and Urban Affairs Committee on Capitol Hill, in Washington, U.S., January 11, 2022. Graeme Jennings | Reuters The Federal Reserve is expected to...

BoC Policy Meeting: It’s Time for a Rate Hike

The Bank of Canada (BoC) is widely expected to kick off the new year with a rate hike on Wednesday despite its muted communication over the past weeks. With inflation well above the central bank’s target and the labor market...

EUR/USD and GBP/USD Elliott Wave Analysis: More Weakness Ahead

The escalation of US-Russian tensions over Ukraine and hawkish Feds policy is worrying for investors which are moving into cash. We see a sharp sell-off on the stock market which may try to stabilize, but technically weakness appears incomplete. If...

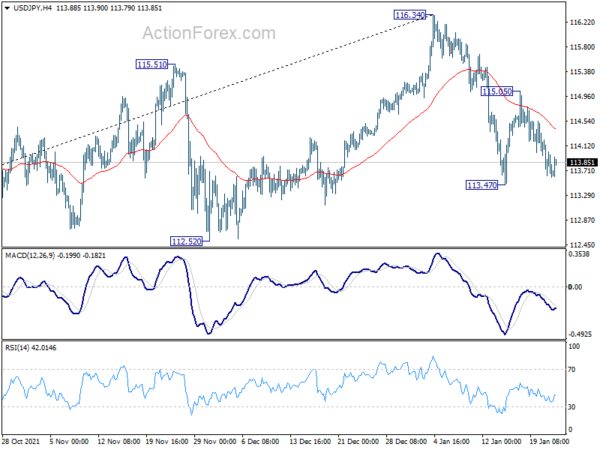

Sentiment Still Weak Despite Big U-Turn in US Stocks, Dollar Firm With Yen

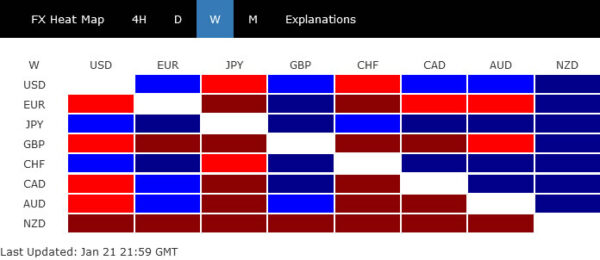

US stocks staged a strong comeback overnight, with DOW staging the first-ever 1000-point-plus intraday U-turn. It’s down -1100 pts at initially trading but closed up 11 pts eventually. Yet, risk-off sentiment remains dominant in Asia. Dollar is currently the strongest,...

Aust Q4 CPI – Core Inflation Already Exceeds Peak in RBA’s Forecasts

Headline CPI 1.3%qtr/3.5%yr; trimmed mean 0.97%qtr/2.6%yr, weighted median 0.95%qtr/2.7%yr. Core inflation is now above the mid-point of the RBA’s inflation target, not something the RBA was expecting in its forecast profile this early nor of this magnitude. Headline inflation came...

Swiss Franc, Dollar and Yen on Risk Aversion as Ukraine Tensions Escalate

Swiss Franc, Dollar and Yen rise strongly today on risk-off sentiment as geopolitical tensions around Ukraine escalate. Aussie is currently the worst performing one, followed by Sterling and then Kiwi. Euro and Canadian are mixed. In the back ground, markets...

Dollar Mixed Awaiting Fed Guidance, Markets Steady in Asia

The forex markets are pretty steady in Asian session even though others trade with a slight risk-off tone. Major pairs and crosses are stuck inside Friday’s range for now. But volatility is guaranteed ahead, with Fed and BoC featured, as...

Asian Open: Flash PMI’s in Focus, AUD Probes Trend Support

Flash PMI data is released across Asia, Europe and the US. And on the back of last week’s risk-off week then markets may be more sensitive to soft data should it disappoint. US equities suffered one of their worst weeks...

Inflation surge could push the Fed into more than four rate hikes this year, Goldman Sachs says

U.S. Federal Reserve Board Chairman Jerome Powell attends his re-nominations hearing of the Senate Banking, Housing and Urban Affairs Committee on Capitol Hill, in Washington, U.S., January 11, 2022. Graeme Jennings | Reuters Accelerating inflation could cause the Federal Reserve...

Yen and Franc in Spotlights Again as Earnings Shook Markets

It’s not Omicron nor Fed rate hike, but earnings. Bullish investors appeared to have finally gave up after disappointing Netflix report last week. NASDAQ led other major indexes sharply lower, and dragged down cryptocurrencies too. Given that Apple and Tesla...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals