Weekly Economic & Financial Commentary: Global Monetary Policy Cycle Tightening Gains Momentum

Summary United States: Hot Inflation Data Widen the Door for a More Aggressive Fed Move in March Consumer prices rose a better-than-expected 0.6% in January, and the details of the report hinted that just as price pressures in some areas...

The Weekly Bottom Line: All Eyes on the Price

U.S. Highlights U.S. prices continued to heat up in January as headline inflation accelerated to 7.5% year-on-year from 7.0% in December. Excluding food and energy, core prices also rose notably over the year to 6.0% with broad-based increases across index...

Michigan Sentiment at Lowest Levels Since 2011, Yet It’s Inflation that Matters!

The preliminary reading for the February Michigan Consumer Sentiment was 61.7 vs an expectation of 67.5 and a January reading of 67.2. This was the lowest reading since October 2011! Most of the miss was due to the Current Conditions...

Stocks making the biggest moves midday: Under Armour, Zillow, Affirm and more

An Under Armour shoe is seen inside of a store on November 03, 2021 in Houston, Texas. Brandon Bell | Getty Images Check out the companies making headlines in midday trading. Under Armour — The sports equipment company’s shares dropped...

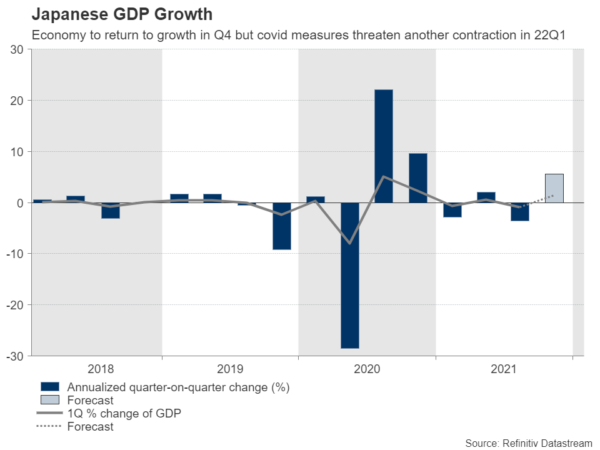

Will the Battered Yen Cheer on Positive GDP Data?

After a negative quarter, Japan’s economy probably returned to the expansion area in the last three months of 2021, GDP data is expected to show on Monday at 23:50 GMT. While the news could put smiles on policymakers’ faces, the...

GBP/USD Outlook: Above Expectations UK GDP Lifts Sterling But Pivotal 1.3600 Barrier Caps the Action

Cable edged higher on Friday, following better than expected UK GDP data which partially offset negative impact from further rise in US inflation that fueled expectations for possible more radical action from Fed. Fresh advance continued to face strong headwinds...

The Fed is still likely to take a measured approach to rate hikes despite calls for bigger action

The Federal Reserve building in Washington, January 26, 2022. Joshua Roberts | Reuters Several Federal Reserve officials, both privately and publicly, are pushing back against calls by St. Louis Fed President Jim Bullard on Thursday for super-sized rate hikes, and...

EUR/USD Outlook: Different Fed-ECB Policy Outlook May Weigh on Euro

The Euro stands at the back foot on Friday following a bumpy ride after US inflation data on Thursday, but the action ended in a long-legged Doji candle, signaling strong indecision. Although Friday’s action is in red, the downside remains...

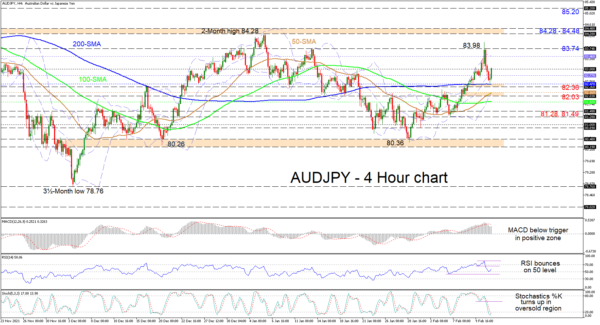

AUDJPY Keeps Bullish Mood Intact with Bounce off 200-MA

AUDJPY has pushed over the mid-Bollinger band and is confronting the 83.00 handle after gaining some traction from the 200-period simple moving average (SMA). The longer-term horizontal SMAs are endorsing the broader neutral picture, while the climbing 50-period SMA, which...

Ending the Week in the Red

Stock markets are ending the week in the red after investors were dealt another inflation blow on Thursday which dampened sentiment once more. We were just starting to see confidence building in the markets, with investors seemingly coming to terms...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals