Equities Stage Relief Bounce on Russia

… but inflation and central bank tightening remain the key risk. The big news this morning came from Russia, which sent stocks and US futures sharply higher, while Brent crude oil dipped back to $94 after rising to above $96...

Pound Dips as Employment Data Looms

The pound is down at the start of the week, ahead of the January data report on Tuesday. In the European session, GBP/USD is trading at 1.3551, down 0.31% on the day. It’s a busy week in the UK, which...

Weekly Economic & Financial Commentary: Global Monetary Policy Cycle Tightening Gains Momentum

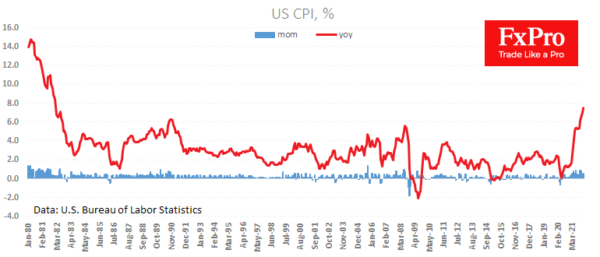

Summary United States: Hot Inflation Data Widen the Door for a More Aggressive Fed Move in March Consumer prices rose a better-than-expected 0.6% in January, and the details of the report hinted that just as price pressures in some areas...

The Weekly Bottom Line: All Eyes on the Price

U.S. Highlights U.S. prices continued to heat up in January as headline inflation accelerated to 7.5% year-on-year from 7.0% in December. Excluding food and energy, core prices also rose notably over the year to 6.0% with broad-based increases across index...

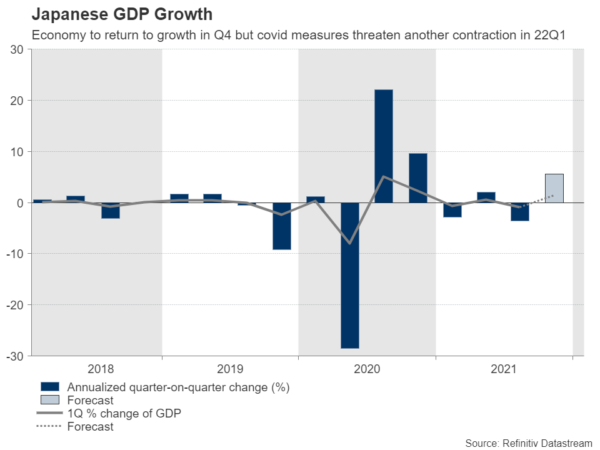

Will the Battered Yen Cheer on Positive GDP Data?

After a negative quarter, Japan’s economy probably returned to the expansion area in the last three months of 2021, GDP data is expected to show on Monday at 23:50 GMT. While the news could put smiles on policymakers’ faces, the...

Ending the Week in the Red

Stock markets are ending the week in the red after investors were dealt another inflation blow on Thursday which dampened sentiment once more. We were just starting to see confidence building in the markets, with investors seemingly coming to terms...

US Inflation to Force the Fed into Action

The US inflation report noted higher-than-expected price rises, triggering a boost to the dollar and a pullback in US major index futures. The price index for January rose 0.6% to an annual rate of 7.5%. The report dashed hopes that...

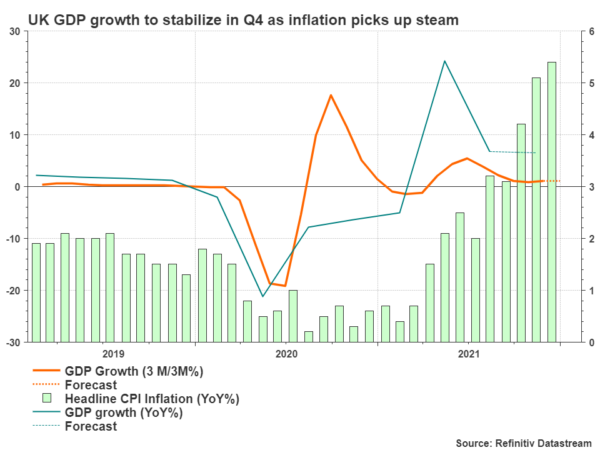

Why UK’s Q4 GDP Growth Data May Not Help the Pound

The UK will publish its final quarterly GDP growth readings for 2021 on Friday at 09:30 GMT. The outcome may not impress investors as forecasts imply the economy almost flatlined at the end of the year, growing more or less...

Higher Yields Start to Bite but Stocks Fight Back, Dollar Edges Up

Bond yields climb to fresh highs as inflation and tighter policy fears grip markets Equities nevertheless perk up globally but Wall Street on shaky ground Dollar regains front foot, oil prices pressured by optimism around US-Iran talks Sentiment improves despite...

Bank of England Update: More Rate Hikes Incoming

Key takeaways As expected, the Bank of England (BoE) raised the Bank Rate by 25bp to 0.50% and announced the beginning of “passive QT” (ceasing reinvestments of maturing bonds) last week. A major surprise was that four out of nine...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals