Weekly Economic & Financial Commentary: Less Positive on the U.S. Dollar Outlook

Summary United States: Supply Chain Woes Tug at Growth and Send Prices Higher This week’s light calendar of economic reports showed supply chain disruptions tugging a little at economic growth. New home sales are being held back by record low...

The Weekly Bottom Line: Core PCE Inflation Shoots Above Symmetric Target

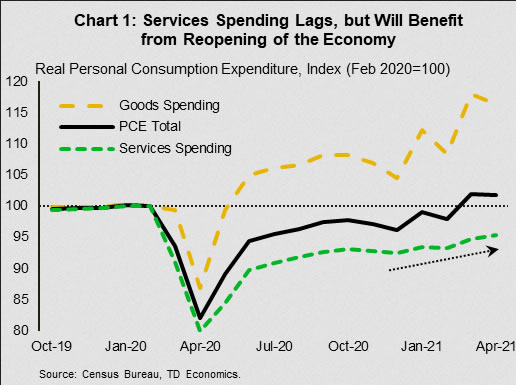

U.S. Highlights First-quarter consumer spending growth was revised up to an even better 11.3% (annualized). Monthly data showed that nominal spending rose 0.5% in April, but inflation-adjusted (real) spending ticked down a touch (-0.1% m/m). The Fed’s preferred inflation gauge,...

Forward Guidance: Canada’s Labour Market Recovery to Take Another Step Back in May

Next week’s Canadian labour market report will show yet another step back in the employment recovery with employment expected to fall by 75K in May. Job losses will be concentrated in the hospitality and retail sectors due to the third...

Week Ahead: OPEC, Non-Farm Payrolls, and RBA Lead the Way

Monday is a US and UK holiday; therefore, market activity should be extremely slow. Month-end flows on Friday saw the US Dollar spike near the US bond open, only to be sold off into the London fix. OPEC meets this...

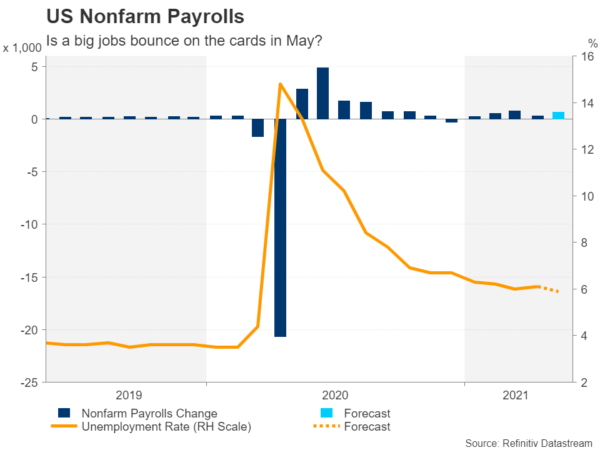

Week Ahead – Could There be Another NFP Shock in Store for the Dollar?

As predictions about higher inflation turn out to be mostly correct, investors haven’t been doing such a good job in reading the health of the US labour market. The May nonfarm payrolls report will be an important test for the...

Weekly Focus – Reflation Trades Take a Break

Despite more very strong data this week, reflation trades took a break this week. US and euro area bond yields drifted lower this week and stock markets moved sideways. Commodity prices retreated with oil and copper prices drifting lower and...

AUD Yawns as Private Capex Shines

The Australian dollar is showing little movement on Thursday. In the North American session, AUD/USD is trading at 0.7739, down 0.01% on the day. Private capex jumps in Q1 It has been a good week for Australian releases. Earlier in...

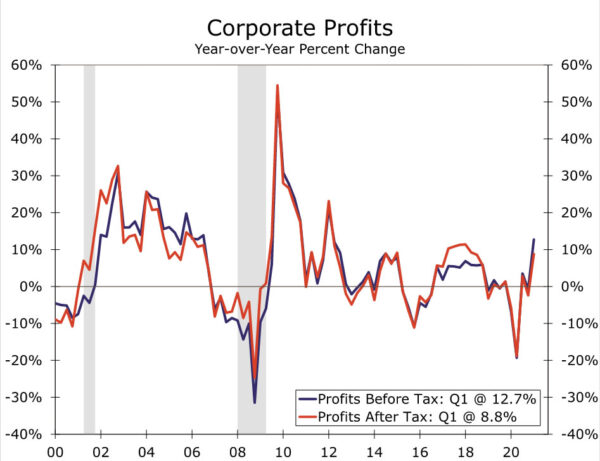

False Profits: Looking Past the Stall in Today’s GDP Print

Summary Revised data show that real GDP grew at an annualized rate of 6.4% in Q1-2021, which is unchanged from the initial estimate that was released a month ago. The overall rate of real GDP growth was driven by broad-based...

Dollar Bears Gather Strength

Global markets have lost growth momentum near recent highs. This indecisiveness can be attributed to the realization that major central banks are slowly but surely moving towards presenting their monetary policy tightening plans. At the moment, this sentiment is benefiting...

Euro Steady, German Consumer Confidence Next

The euro is showing limited movement on Wednesday. In the North American session, EUR/USD is trading at 1.2236, down 0.13% on the day. There are no eurozone events on the calendar, so we can expect the pair to remain calm...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals