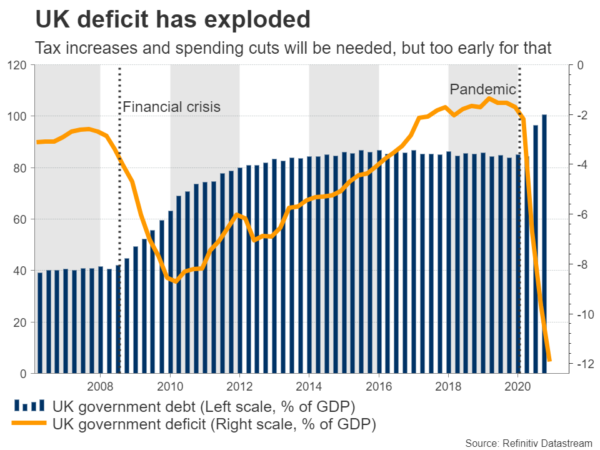

What Does the UK Budget Hold for Sterling?

The Chancellor of the Exchequer will unveil the latest UK Budget on Wednesday at 12:30 GMT. It will likely include another massive round of spending to safeguard jobs and boost the recovery. Rumors suggest taxes on corporations might be raised...

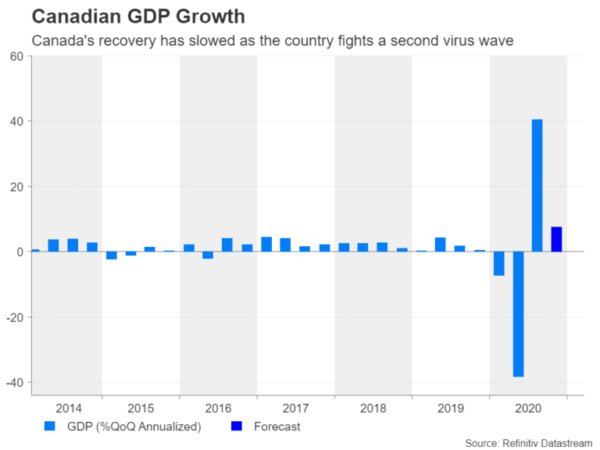

Loonie Remains Choppy Ahead Of Canadian GDP, OPEC+ Decision

Fourth quarter GDP numbers will be watched out of Canada on Tuesday (13:30 GMT) as the recovery is expected to have lost steam. Nevertheless, the Canadian dollar has been edging higher so far in 2021 as a red-hot housing market,...

US: Manufacturing Sector’s Recovery Continues Unabated

TD Bank Financial Grouphttp://www.td.com/economics/ The information contained in this report has been prepared for the information of our customers by TD Bank Financial Group. The information has been drawn from sources believed to be reliable, but the accuracy or completeness...

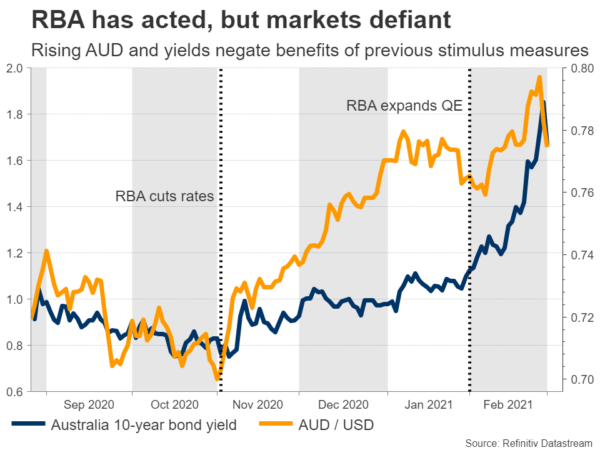

Can the RBA Shoot the Aussie Down?

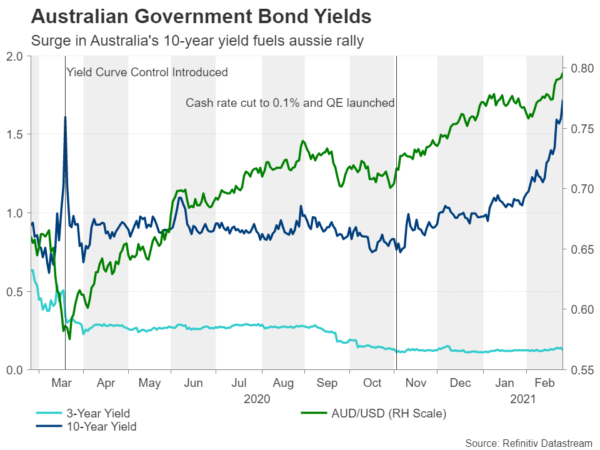

The Reserve Bank of Australia (RBA) will conclude its March policy meeting at 01:30 GMT Tuesday. The domestic economy is doing well and commodity prices have soared, but the RBA won’t be happy about the recent surge in bond yields...

Weekly Economic & Financial Commentary: The U.S. Economy Continues to Start 2021 on a High Note

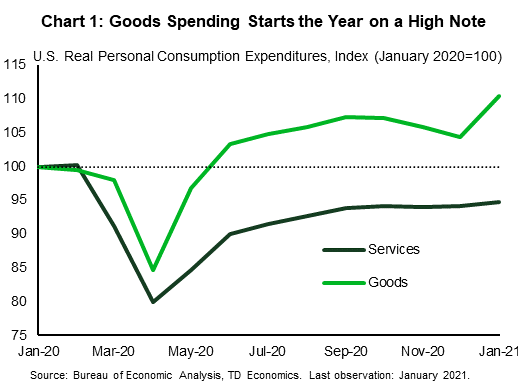

U.S. Review The U.S. Economy Continues to Start 2021 on a High Note In January, personal spending increased at a robust 2.4% pace, while personal income soared 10.0%. The core PCE deflator rose 0.3% during the month and 1.5% over...

The Weekly Bottom Line: BoC Govenor Strikes Cautious Tone

U.S. Highlights Federal Reserve Chairman Powell reassured markets that there will be no early tightening of monetary policy or drawdown of asset purchases even with a brighter economic outlook. Consumers remain at the forefront of the recovery, as personal income...

Week Ahead: When Doves Cry

Fed Chairman Powell provided testimony to Congress last week regarding Monetary Policy. He noted that the Fed was in no hurry to take its foot off the easing pedal and that although inflation expectations have been creeping into the markets,...

Week Ahead – Rising Yields Spook Markets

Powell fails to ease concerns Everyone is watching the bond markets at the moment, as yields accelerate higher and investors become increasingly anxious. That is dominating the headlines and it’s unlikely to change next week, with the jobs report on...

Week Ahead – NFP to Guide Yields, RBA Could be a Yawn, Pound Turns to UK Budget for Boost

As a new month starts, investors will have their eyes locked on the latest nonfarm payrolls numbers out of the United States amid an accelerating selloff in bond markets. The Reserve Bank of Australia’s policy meeting will be the only...

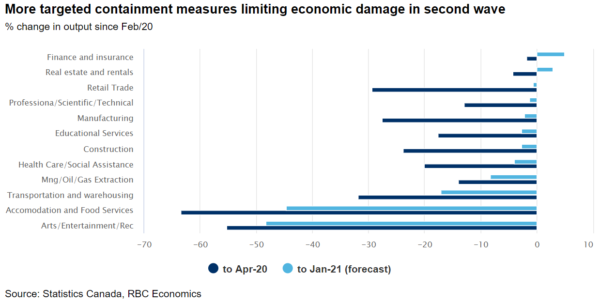

Forward Guidance: Canada GDP to Confirm Economy Weathered Second Wave

We expect GDP rose 7.5% at an annualized rate in Q4 of last year, on the back of a 0.3% increase in December output (in line with Statistics Canada’s preliminary estimate a month ago.) That would mean about 80% of...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals