Dollar Higher on Jobless Claims, Cautious ahead of Trump-Liu Meeting and NFP

Dollar rises broadly in early US session as partly helped by pleasant surprise in initial jobless claims, which fell to lowest since 1969. But gains are so far limited as markets are awaiting meeting between Trump and Chinese Vice Premier...

Markets Mixed as US-China Trade Talks Enter into Final Stage

Chinese stocks extend recent rally on news that US-China trade negotiation are completing its final stage. There could even be an announcement of Trump-Xi summit today and Trump meets Chinese Vice Premier Liu He. However, outside China, the markets are...

Poor US ADP and UK PMI Services Ignored, Risk Appetite Stays Strong

Risk appetite are generally firm globally today and it’s best reflected in Germany 10-year yield, which turns positive for the time in more than a week. It’s a rather clear indcation of a positive turn in overall sentiments. There is...

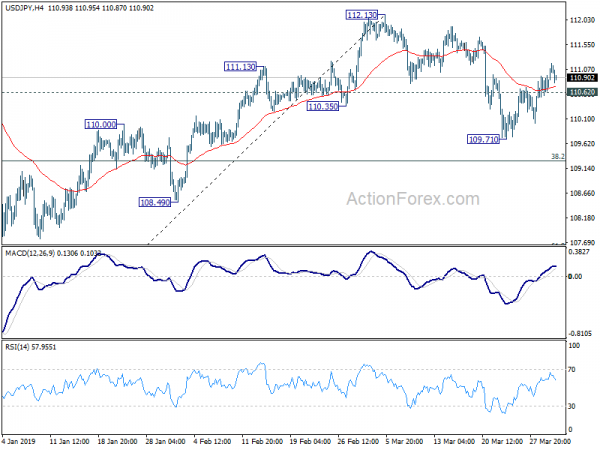

Trade Talk Optimism and Chinese Service Data Lift Sentiments, Yen Pressured

Yen is back under pressure again today as Asian stock markets extend this week’s rally. Stronger than expected Chinese services data is lifting sentiments. Meanwhile, there is somewhat some optimism on US-China trade negotiations, which is restarting in Washington today....

Dollar Trading Higher Despite Durable Miss, Sterling Soft in Established Range

Dollar trades generally higher today even though upside momentum is capped by weaker than expected durable goods report. Economic data released this week are so far mixed. But at least, they don’t point to heightened recession risk. While long treasury...

Australian Dollar Tumbles as RBA Signals It’s Ready to Move

Australian Dollar trading broadly lower today after RBA kept interest rate unchanged. While there was no clear dovish shift, the statement suggests that RBA is starting to get ready for a move. Weakness in Aussie takes New Zealand Dollar lower...

US Retail Sales Disappointment Raises Doubts on Optimism from Chinese Data

Global markets are generally in risk-on mode today as recession fears eased mildly after improvement in Chinese manufacturing data. While sentiments remain generally positive in early US session, there is a slight bit of cautiousness after disappointment retail sales from...

China Manufacturing PMIs Back in Expansion, Asian Stocks and Australian Dollar Lifted

Stock markets staged a strong rally in Asian session as lifted by better than expected manufacturing data from China. Both official and Caixin PMI manufactured climbed back into expansionary region, suggests that the worst could be over. Australian Dollar jumps...

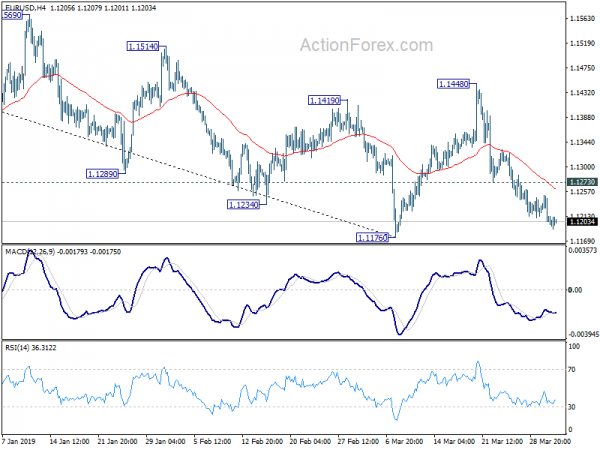

Risk Aversion to Come Back in Q2 as Stocks and Yields Recouple

Intensifying recession fear was the main theme in the markets in March, alongside never-ending Brexit and trade tensions. With downside risks to growth starting to materialize, major global central banks started their dovish turns. Most notably, Fed now forecasts no...

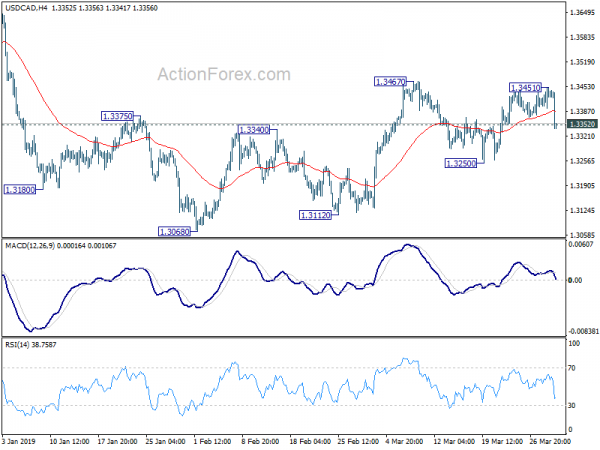

Canadian Dollar Surges on GDP Surprise and Oil Rally, Sterling Recovers ahead of Brexit Vote

Canadian Dollar jumps sharply in early US session after stronger than expected GDP data. At least, the three month-rolling average remained in expansion despite the contraction in December and November. Additionally, WTI crude oil surged through recent resistance to resume...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals