S&P 500 Bull Market Given a Clean “Bill of Health” by 2019 Sector Performance

Roughly four months after the Christmas swoon in US stocks, sector rotation suggests the bull market is alive and well. For the uninitiated, sector rotation is the subset of technical analysis that involves evaluating what types of stocks are performing...

Earnings and data could be proof that slowdown fears were overblown

Earnings season shifts into a higher gear in the week ahead, as investors also watch for fresh economic data that could show that the economy is pulling out of a temporary rut. Amazon, Boeing, Microsoft and ExxonMobil are among more...

Week Ahead – US Next to Report Q1 GDP; BoC and BoJ Meet Amid Growth Worries

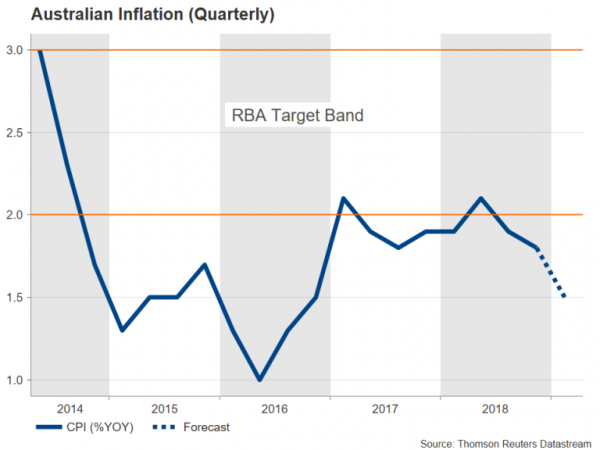

After China’s upbeat growth numbers this week, all eyes will be on the US economy’s performance during the first quarter. Aside from the US GDP, it’s going to be a rather quiet seven days for economic data due to the...

Most Markets Closed for Good Friday; Euro Trades in 20 Pip Range

Most traders are enjoying a three-day weekend as markets observe Good Friday. Overnight, Asian markets finished higher as the Nikkei rose 0.5%, the Shanghai Composite closed 0.6% higher, the ASX 200 eked out a 0.1%, while the Hang Seng fell...

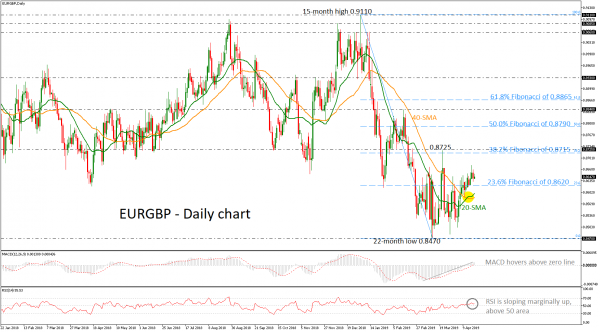

EURGBP Consolidates the Last 2 Months; Indicators Suggest Bullish Bias

EURGBP is in a neutral mode after tumbling below the 38.2% Fibonacci retracement level of the downleg from the 15-month high of 0.9110 to the 22-month low of 0.8470 on February 19; prices are consolidating within the 0.8715 resistance and...

Country risk: Argentina is on a bumpy ride to better fortunes

President Macri needs to rein in Argentina’s economic problems to win re-election in October Argentina’s risks have continued to edge higher this year, despite capital flows to emerging markets benefiting from a pause in the US Federal Reserve’s interest rate...

US 500 Index Flies Near 6-month Peak; All-time High is Near

The US 500 index price skyrocketed to a fresh six-month high of 2918 on Thursday before it pared those gains later in the day. The price is holding above the red Tenkan-sen line as well as above the ‘golden cross’...

USDCAD Finalizes Symmetrical Triangle Formation

USDCAD had another uneventful week as it was congested within the 1.33 area. According to the RSI and the MACD the pair is likely to continue consolidating in the short-term as both indicators show no clear direction. Yet and more...

GBPJPY on a Sideways Move; 23.6% Fibonacci Appears to be Strong Support

GBPJPY has been on a sideways move for the most part of the week as the 23.6% Fibonacci retracement level of the upleg from 132.48 to 148.85, around 145.00 and the 200-day simple moving average seem to be critical obstacles...

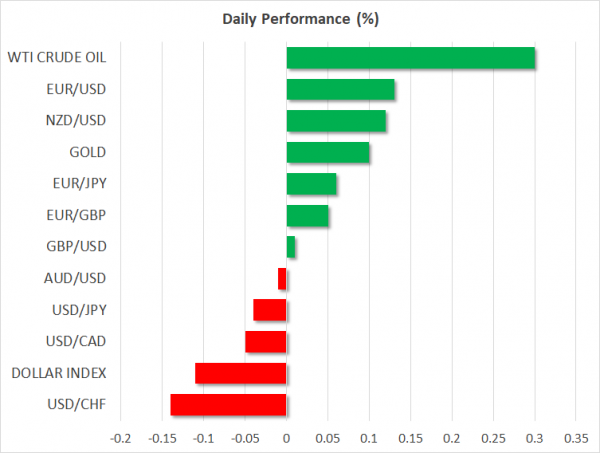

Dollar Powers ahead on Strong US Data; Euro Stumbles

US dollar and Wall Street lifted by solid economic data and earnings But euro, pound, aussie and kiwi turn lower on Eurozone woes, resurgent dollar Thin liquidity expected today as many markets closed for Good Friday US recession fears ebb...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals