Stock Investors Remained Bearish; Gold ETFs Witnessed Biggest Inflow

*Oil fell as trade war stoked growth concerns *UK Parliament is likely to delay Brexit by Jan next year Stocks The S&P 500 Index was closed due to a bank holiday. It closed on 2926 on its final day of...

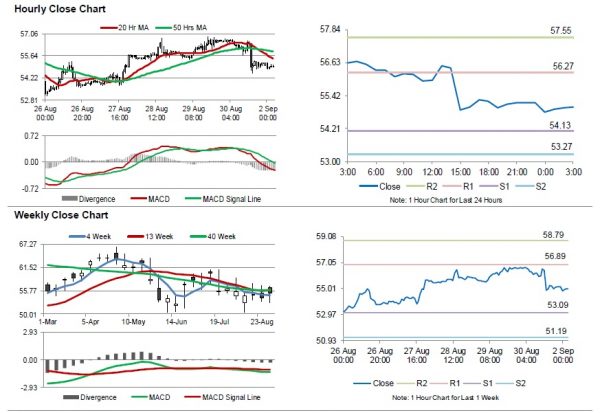

WTI OIL Outlook: Bears Take a Breather above Key Fibo Support

WTI oil price is holding in sideways mode on Monday, contained by important Fibo support at $54.45 (61.8% of $52.95/$56.88) and consolidating after Friday’s strong fall. Escalation of US-China trade war increases pressure on oil price as fears of reduced...

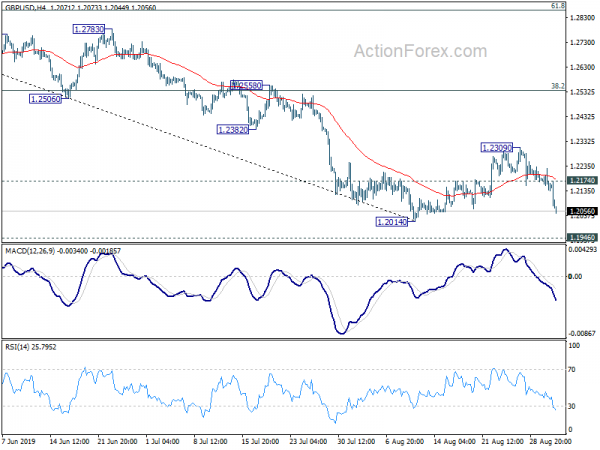

Sterling Tumbles on Poor Manufacturing Data and Political Uncertainties

Sterling drops sharply today as after poor manufacturing data. Also, political and Brexit uncertainties remain in UK. There are “very strong” rumors that a general election could be called this week that could take place before Brexit date of October...

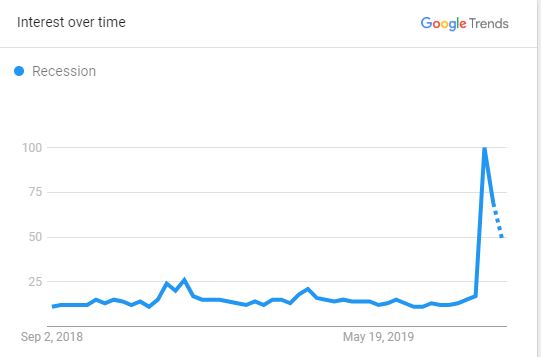

Here’s a list of recession signals that are flashing red

Traders and financial professionals work on the floor of the New York Stock Exchange. Drew Angerer | Getty Images Whether or not the U.S. is going into a recession is on the minds of Americans everywhere. Google searches show recession...

FTSE Spikes On Sterling’s Brexit Wobble

European markets are looking a little flat at the start of the week, with the FTSE 100 being the exception, up around 1%, as sterling suffers another Brexit blow. Boris Johnson – like the cause he supported and is determined...

USDJPY Slight Risk Aversion

The US dollar has had a fairly soft start to the new trading month against the Japanese yen currency, after the new Sino-US trade tariffs took effect over the weekend. The overall trading sentiment is fairly weak, which is keeping...

Crude Oil: Oil Trading Lower In The Asian Session

For the 24 hours to 23:00 GMT, Crude Oil declined 2.65% against the USD and closed at USD55.09 per barrel on Friday, after Russian Energy Minister, Alexander Novak, stated that Russia’s oil output cuts in August will be slightly lower...

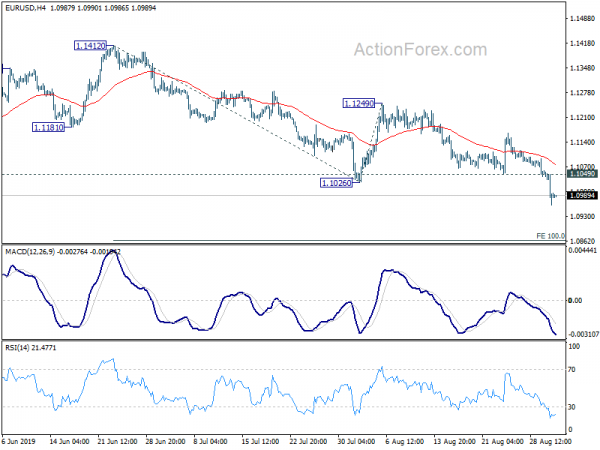

Dollar and Yen Mildly Higher as Markets Shrug New US-China Tariffs

Dollar and Yen firm up mildly in Asian session as markets started the month mixed. New round of US-China tariffs took effect over the weekend but market reactions are muted so far. Australian Dollar softens mildly, followed by Swiss Franc...

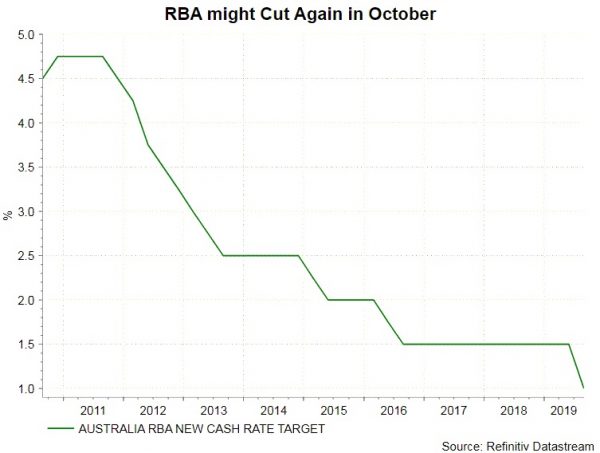

RBA Preview – Staying Put before Further Easing

Although the market generally expects RBA to leave the cash rate unchanged at 1% this week, the chance of a surprise cut is not negligible. Despite mild pickup in confidence after the back-to back rate cuts in June and July,...

Consumers could be winners as Singapore shakes up its digital banking sector

A customer uses an automated teller machine in Singapore. Nicky Loh | Bloomberg | Getty Images Singapore is about to shake up its banking sector for the first time in two decades — a move that would allow technology players...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals