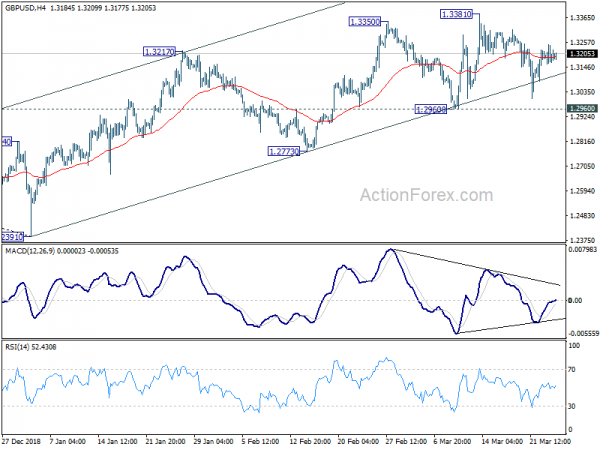

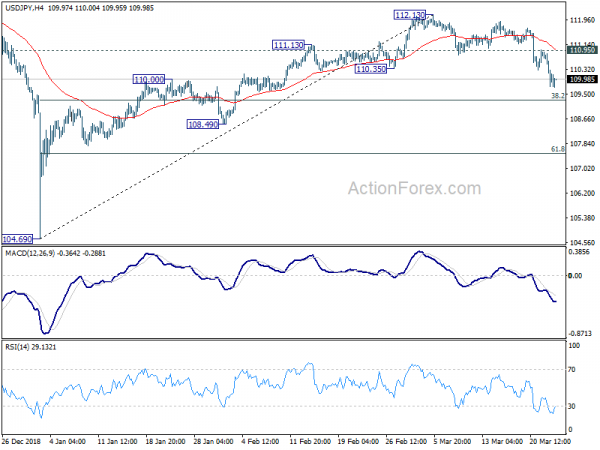

Yen Softer as Stocks & Yields Rebound, Pounds Awaits Another Brexit Vote

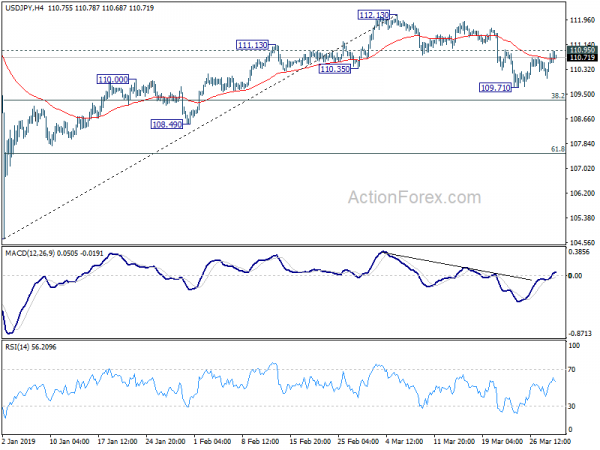

Yen is under some mild selling pressure today as China stocks lead Asian markets higher. While US 10-year yield failed to sustain above 2.4 handle overnight, it looks like recent decline has stabilized some what. And some more recovery in...

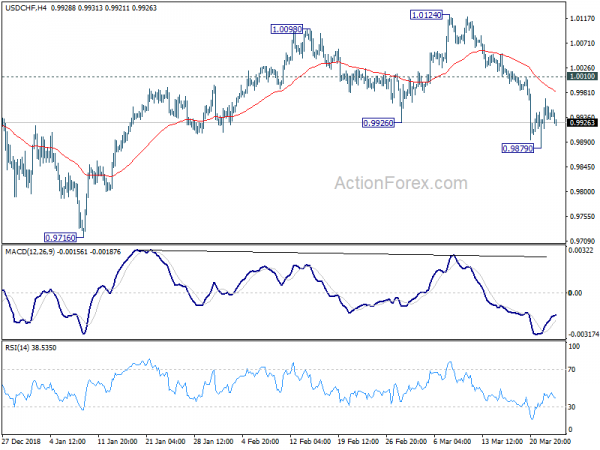

Dollar Higher as Treasury Yields Attempting Rebound, Sterling Stays Weak on Brexit

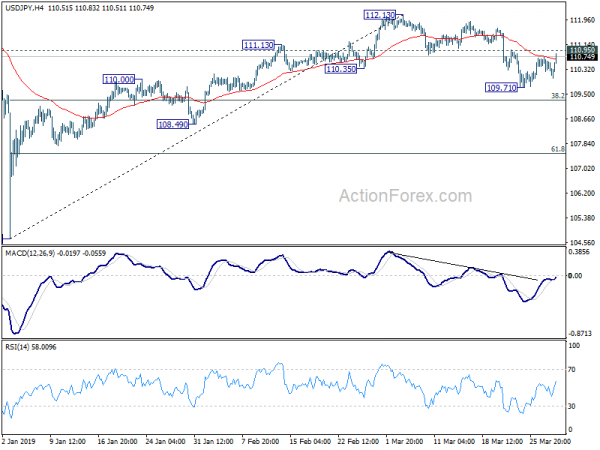

Dollar rises broadly in early US session with help from rebound in treasury yields. 10-year yield is now trying to regain 2.4 handle. Poor Q4 GDP is ignored while traders could be hopeful on some progress in US-China trade talks...

Brexit Stalemate Continues, US-China Trade Talks Resume, Euro Vulnerable

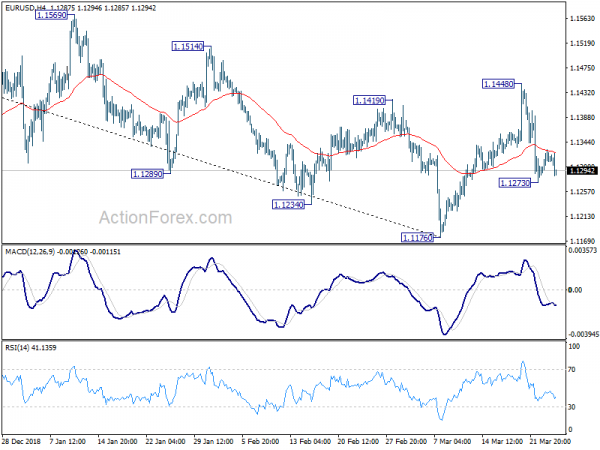

The forex markets are relatively quiet as quarter end approaches. Sterling remains stuck in range as Brexit stalemate continues. The UK Parliament continued to tell the world what they don’t want regarding Brexit, but not they really want. Meanwhile, US-China...

Sterling Higher ahead of Brexit Indicative Votes, Yen Higher as Treasury Yields Extend Slump

Indicative votes on Brexit alternatives in the UK House of Commons will catch most attention ahead. Debate is due to start by 1500GMT. We’ll see what alternative Brexit path could gain majority in the Parliament. House of Commons Speaker John...

Selloff in New Zealand and Australian Dollar Dominates on Rate Cuts Bets

Selloff in New Zealand and Australian Dollar is the main theme in Asian session today. Kiwi plummets after RBNZ stands pat and indicates that the next move is a cut. After that, a full RBZN cut in priced in November...

Yen Lower as CAC Leads European Stocks Higher, Sterling Rises on Revived Brexit Hope

The forex markets are staying in consolidative mode today. Sterling rises notably as some Brexiteers are finally agreeing that Prime Minister Theresa May’s deal is better than no Brexit. At least, there is a chance for future governments to adjust...

Sterling Range Bound after Parliament Took Control on Brexit, Votes on Alternatives Next

The forex markets are relatively mixed this week, in particular Sterling. Pound is staying inside familiar range even though the Parliament finally seized control over Brexit from the government. Focus will turn to Wednesday’s indicative votes but it’s uncertain whether...

Sentiments Stabilized after German Confidence Data, Brexit to Take Spotlight Again

Market sentiments generally stabilized today after initial selloff in Asia. While major European indices are still in red, losses are so far very limited. German 10-year bund yield even managed to turn positive briefly. Better than expected German Ifo Business...

Risk Aversion Continues With Focus on German Ifo and Brexit

Risk aversion dominates in the Asian markets today as recession fears spread. But the currency markets are steady though. Major pairs and crosses are bounded inside Friday’s range at the time of writing, with mild weakest in Sterling and Swiss...

Sentiments Turned Very Fragile as Recession Fears Intensified

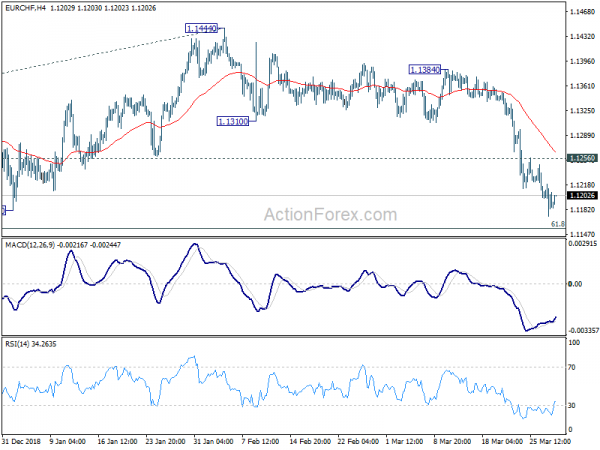

After the much more dovish than expected Fed economic projections and shockingly poor Eurozone manufacturing data, it looks like major world economies are at the brink recessions. German 10-year bund yield turned negative for the first time since 2016, and...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals