US-China Trade Talks Supports Sentiment, But Risks Like Brexit Remain

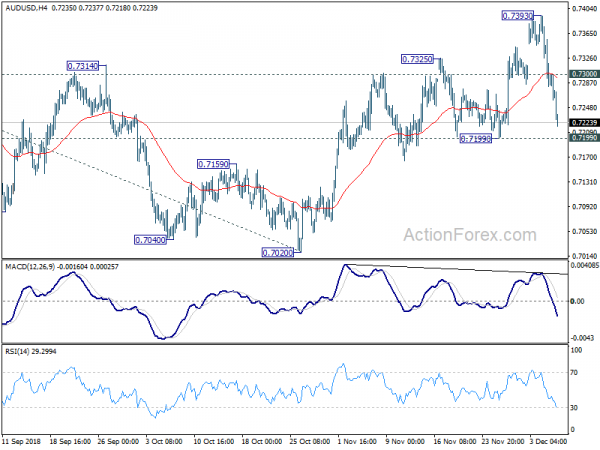

New Zealand and Australian Dollar are trading as the strongest ones today so far, following rebound in Asian stocks. Nevertheless, both currencies are generally limited below last week’s highs, indicating unconvincing upside momentum for now. Indeed, sentiments did turn more...

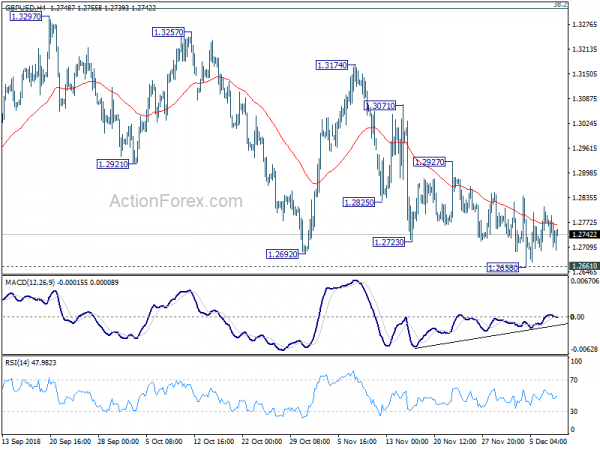

Risk Appetite Come Back as China Mulls Auto Tariff Cuts, Trump Hints on Important Announcements

Risk appetite has a strong come back today on progress in US-China trade negotiations. It’s reported that China is considering to response to Trump’s request and cut auto tariffs down from 40% to 15%. Trump also tweeted that there were...

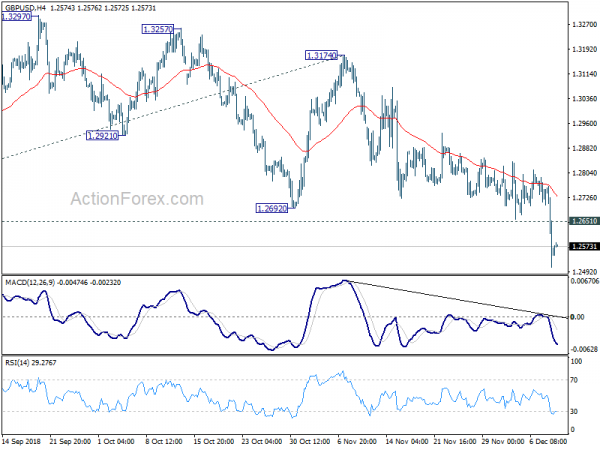

Sterling Stays Pressured on Brexit Uncertainty, Asian Markets Calm after Wild Ride in US

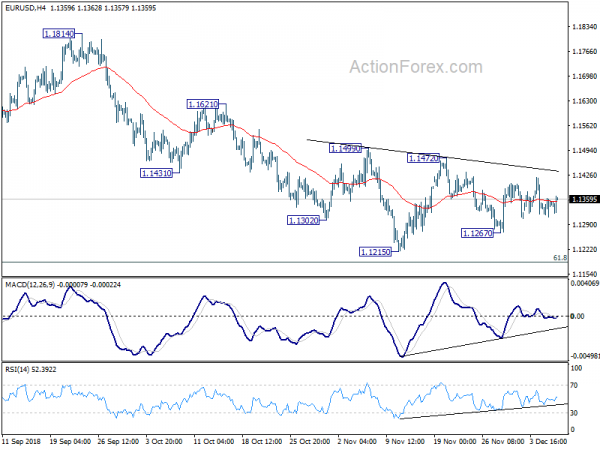

Sterling tries to recover some ground in Asia, after yesterday’s heavy selloff. But there is no sign of a turn a round in the Pound. The Brexit parliamentary vote is now called off and UK Prime Minister Theresa May is...

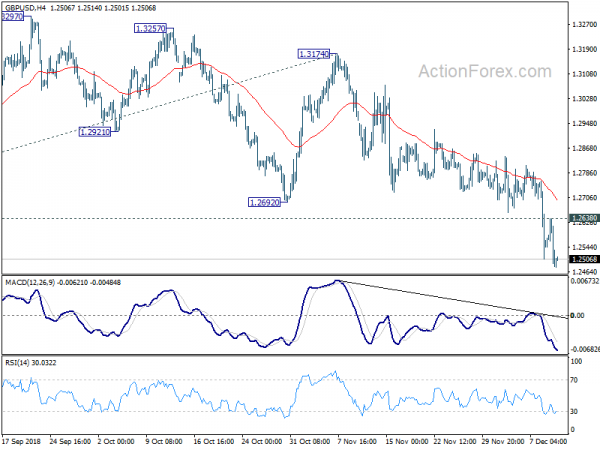

Pound Tumbles as UK PM May Will Call off Brexit Parliamentary Vote, Abruptly

Pound is at the center of focus today as it finally shows some commitment on the downside. The trigger of the selloff is report that UK Prime Minister Theresa May is going to call off tomorrow’s Brexit parliamentary vote. Weak...

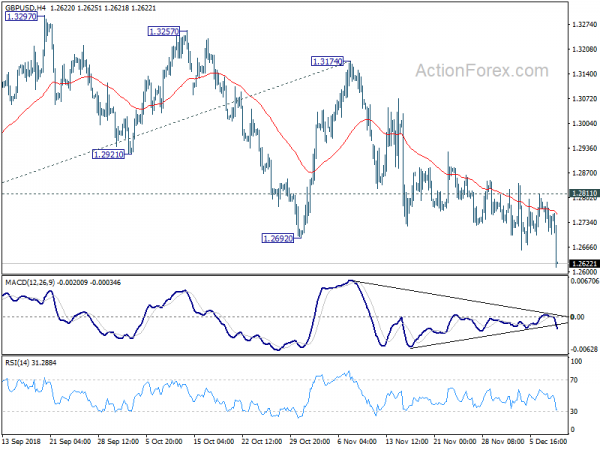

Sterling Might Wake Up as Brexti Vote Approaches, Busy Week Ahead

Asian stocks open the week lower, following Friday’s selloff in the US. But the forex markets are pretty steady. Dollar is the weakest one for now, followed by Sterling and then Canadian. On the other hand, New Zealand Dollar leads...

Yield Curve Inversion and Global Slowdown Hammered Stocks, Not US-China Trade Talks

It was another volatile week with multiple theme working on the markets. US-China trade truce, arrest of Chinese business executive, stock market routs, treasury yield free fall, US yield curve inversion, weak economic data and global slow down, OPEC+ production...

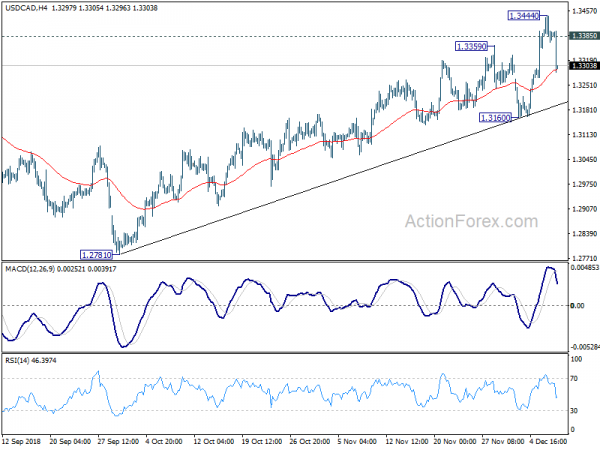

Canadian Dollar Strikes Back on Stellar Job Data, Dollar Shrugs NFP Miss

Dollar spikes lower in early US session after non-farm payroll report showed lower than expected job and wage growth. That adds to argument that the momentum US job growth has peaked. Nevertheless, there is no follow through selling in the...

Sentiments Stabilized with DOW’s Late Rebound, Dollar Turns to Non-Farm Payrolls

Risk sentiments generally stabilized after the late rebound in US stocks overnight. DOW hit as low as 24242.22 but closed at 24947.67. Down just -0.32%. S&P 500 also hit as low as 2621.53 but closed at 2695.95, down only -0.15%....

Dollar Slightly Lower on Job Data Miss, But Risk Aversion Still the Main Theme.

Dollar softens mildly against European majors in early US session after weaker than expected job data. But risk aversion remains the overall theme of the market. Australian Dollar stays the weakest one, followed by Canadian and New Zealand Dollar. WTI...

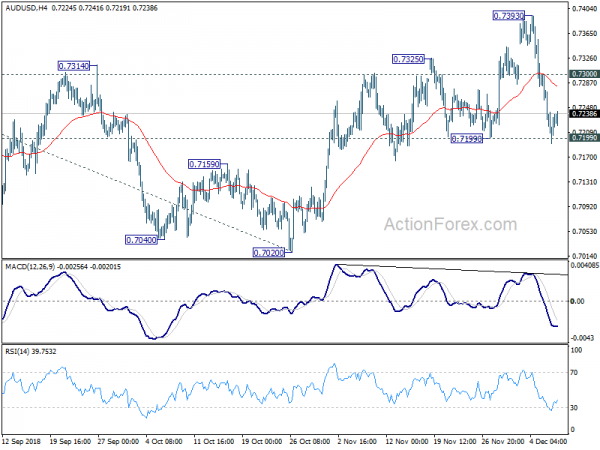

Australian Dollar Dives Again as Risk Aversion Intensifies on Chinese Tech Giant Huawei

Risk aversion intensifies in Asian session again. In particular, Hong Kong stocks lead the decline on news of arrest of Chinese tech giant Huawei’s CFO Meng Wanzhou. The arrest is reported to be in relation to Huawei violating US sanctions...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals